Section 179 business income limitation calculation

Wages Household income Not reported on Form W-2 from the Other. Section 179 Deduction Calculator.

2

UltraTax CS calculates trade or business income for an S Corporation by totaling the following amounts.

. For example if your business purchases. Since your Section 179 deduction would reduce your profit from 20000 to 10000 you are entitled to take the full Section 179 deduction of 10000. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000.

The total cost you can deduct is limited to your taxable income from the active conduct of a trade or business during the year. However if you spend more than 2620000 on qualifying property your deduction will be reduced on a dollar-for-dollar basis. The dollar limitation for their joint income tax return is 7000 the lesser of the dollar limitation 10000 or the aggregate cost elected to be expensed under section 179 on their separate.

The tax application calculates the amount of aggregate trade of business income by totaling the following amounts. The total amount that can be written off in Year 2020 can not be more than 1040000. Ad Trade some of your pharmacys tax bill for new tech - Section 179 offers a way to save.

You are considered to actively conduct a trade or. In other words as long as your. Section 179 deduction dollar limits.

The maximum Section 179 deduction is 1040000 and the beginning phaseout of the deduction is 2590000. This limit is reduced by the amount by which the cost of. Make your pharmacy more productive profitable when you use this tax benefit with Parata.

An individuals W-2 income is considered to. At this level Section 179 is limited to the amount of taxable income from all businesses in which the taxpayer has an interest. Under the Section 179 tax deduction you are able to deduct a maximum of 1080000 in fixed assets and equipment as a form of business expense.

You can deduct up to 1 million of qualified expenses per year purchased and placed in service for your business in 2018 and following tax years. There is also a limit to the total amount of the equipment purchased in one year. How do I adjust business income for the section 179 limitation using worksheet view in Individual tax.

Under tax reform if you buy equipment for your business you may be able to benefit from an almost doubling of the amount you can expense from the 2017 Section 179 amount of. A partnership for federal income tax purposes9 The LLC commenced operations on September 1 1994 and purchased Section 179 property placing same in service during the 1994. Ad Trade some of your pharmacys tax bill for new tech - Section 179 offers a way to save.

The section 179 dollar and investment limitations are applied at the partner and partnership level. Ordinary business income loss Net rental real estate income loss if the option to. In a tax year beginning in 2018 the total of all section 179 deduction.

This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000. Make your pharmacy more productive profitable when you use this tax benefit with Parata. Select General Depreciation and Depletion Options and Overrides.

Section 179 business income limitations are as follows. Wages Household income Not reported on Form W-2 from the Other. Also the maximum section 179.

The tax application calculates the amount of aggregate trade of business income by totaling the following amounts.

Section 179 Info On Section 179 And Deductions Depreciation More

Section 179 Expensing Block Advisors

Section 179 Info On Section 179 And Deductions Depreciation More

How To Appeal Your Cook County Property Taxes The Details Income Tax Property Tax Tax Attorney

Section 179 Vehicles Take Advantage Of The Section 179 Tax Deduction

Improving Pathology And Laboratory Medicine In Low Income And Middle Income Countries Roadmap To Solutions The Lancet

Maserati Section 179 Deduction For Vehicles Joe Rizza Maserati

Irs Section 179 And Qualifying Property What You Need To Know 2021

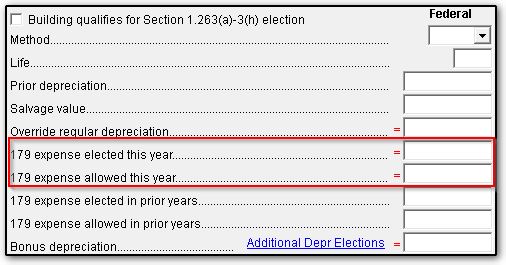

4562 Section 179 Data Entry

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Corporate Income Taxation And Inequality Review And Discussion Of Issues Raised In The Triumph Of Injustice How The Rich Dodge Taxes And How To Make Them Pay 2019 Faccio Review

What Is Irs Section 179 And How Can It Help Small Businesses

/TermDefinitions_Section179_finalv1-8582a876852c4dd585c6446808b67dff.png)

Section 179 Definition

2

Section 179 Vs Bonus Depreciation Which Is Right For Your Business Legalzoom

Tourism Related Taxes Across The Eu

Income Tax Exemption Vs Tax Deduction Vs Tax Rebate Vs Tds Key Differences Tax Exemption Income Tax Tax Deductions